How Business Capital can Save You Time, Stress, and Money.

Wiki Article

Unknown Facts About Business Capital

Table of ContentsBusiness Capital for BeginnersBusiness Capital - The FactsThe Basic Principles Of Business Capital Indicators on Business Capital You Need To KnowThe Best Guide To Business CapitalThe 7-Minute Rule for Business Capital

Debt funding is money that has actually been borrowed to aid support a service' resources framework. This cash might be borrowed over either short-term or longer term durations. How a lot it costs the company is determined by their stability; if they're extremely ranked as well as able to obtain with low prices, it looks much better for a firm than if their risk determines a higher percentage rate on what they obtain.The different parts of financial debt in capital structure include: Senior Financial debt: If a firm deals with monetary trouble or submitted for insolvency, financing under this group earns money back initially. Senior debt lendings often tend to have a reduced rate of interest. Subordinated Financial debt: These financings aren't as risk complimentary as senior financial obligation lendings, yet their greater rate of interest indicate lending institutions can make their cash back and also after that some.

The Facts About Business Capital Revealed

It might not be the most convenient method to construct business funding framework, which is why car loans or tiny business funds can be a much less complex optionalthough the application procedure may be more involved, calling for a service strategy as well as an overview of expenses. This financial obligation is a little organization's dream come to life due to the fact that it only pays rate of interest, and the principal doesn't have to be settled for a long time.Firms might rely on this kind of financial obligation to cover any costs owed to vendors, liquidating items to construct their company while pleasing economic partners. Insurance provider rely on this type of financial debt to cover prices as needed or being in an account and make rate of interest until the financial debt needs to be paid off.

Whether you are beginning an organization, or scaling up an existing one, the relevance of having adequate capital can not be overstated. Practically every entrepreneur has actually utilized bootstrapping or small service car loans at some factor in their careers.

Little Known Facts About Business Capital.

This typically permits you to grow your company a lot more rapidly. The downside, though, with financing is that you go from having full possession of your business to having component ownership. Your new capitalists may intend to have input on the instructions of business, as well as you will certainly be answerable to meet the timelines of your capitalists.This will differ depending upon your business. And after that there are the prices of working capital to think about. Just how much do you require to pay for rental fee, marketing, as well as salaries? The even more cash you need, the harder bootstrapping will certainly be, as well as the much more eye-catching seeking exterior financing will certainly end up being.

We 'd more than happy to discuss your alternatives with you as well as aid you find an option that fits your company.

The Facts About Business Capital Revealed

Capital is a prevalent statistics for the efficiency, liquidity as well as general wellness of a firm. It is a reflection of the outcomes of numerous business activities, including earnings collection, debt management, inventory management as well as payments to providers. This is since it includes supply, accounts payable image source and also receivable, cash, portions of debt due within the duration of a year and various other short-term accounts.

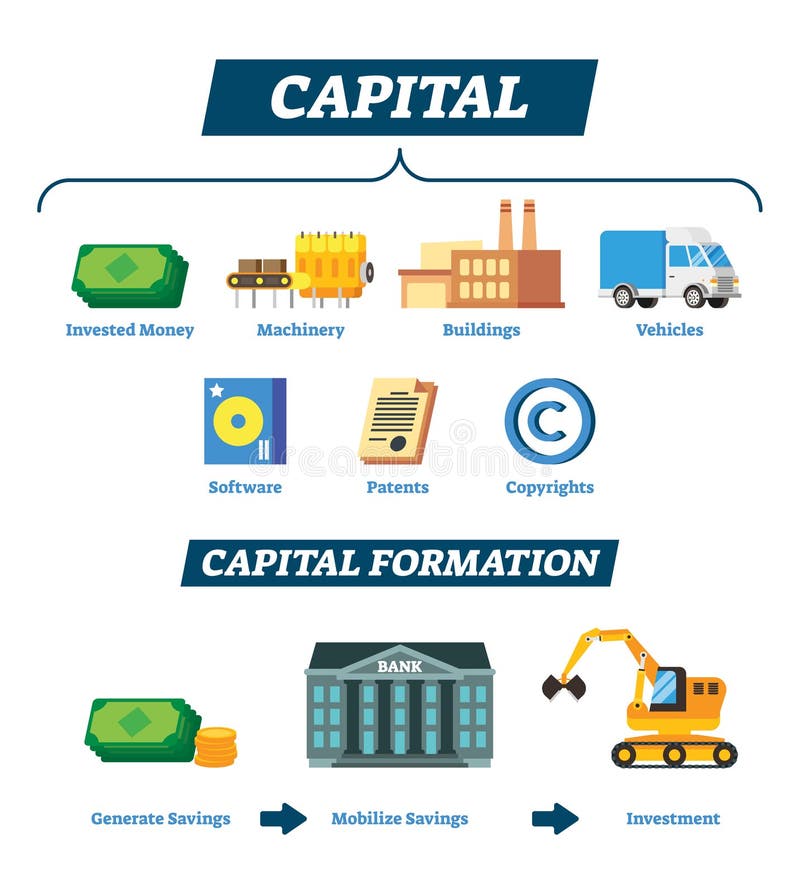

Funding can also represent the collected wide range in a service, or the owner's investment in a business. Exactly how the service proprietor's funding account is structured depends on the type of company.

The Basic Principles Of Business Capital

The person makes a capital payment to business when they sign up with, buying business. Partner share of revenues and losses is identified by the partnership agreement or LLC operating agreement, based upon their capital share. Shareholders in a firm have shares of possession. They acquire shares and get dividends based on the variety of shares they have.It's feasible for a service to have an additional organization. A corporation might be a part-owner of an LLC. In this situation, the funding account may not be just a one-person account.

Each owner of a company (other than companies) has a separate funding account, which is shown on the balance sheet as an equity account. (Equity is one more word for possession.) This resources account is added to or deducted from for the complying with occasions: The account is enhanced by proprietor contributions. These might be first payments when joining the you can try these out company, or later on investments as called for or determined upon by the owners.

Business Capital Things To Know Before You Buy

The account is also subtracted from for any type of distributionstaken by the owner for his or her personal use. As an example, let's state 2 individuals join to create an LLC. Each places in $50,000, so each capital account begins out with $50,000. They are likewise 50% owners as well as they consent to distribute earnings as well as losses utilizing this percentage.Throughout the year, each owner took money out their explanation of the service for personal usage. When you start a service, you will certainly almost certainly have to place in money to obtain it going.

Report this wiki page